Wondering how to switch bank accounts in the Netherlands? Whether you’re looking for better rates, improved customer service, or features that better suit your needs, the transition doesn’t have to be complicated.

From notifying your current bank to setting up your new account and transferring automatic payments, a little preparation goes a long way.

Reasons to switch bank accounts in the Netherlands

There are many reasons someone may want to switch bank accounts in the Netherlands, including some you may haven’t even considered yet:

- Better interest rates: A person might switch banks to take advantage of higher interest rates on savings accounts or lower interest rates on loans and mortgages.

- Lower fees: Banks usually charge fees for services like maintaining accounts, withdrawing money from ATMs, or international transfers. You may switch to a bank with fewer or lower fees to save money.

- Better digital services: With the rise of online banking, people might switch to a bank that offers a more user-friendly app, better online banking services, or innovative features like budgeting and saving tools.

- More seamless international banking options: Expats of frequent travellers might benefit from switching banks to access better international banking services, such as lower foreign exchange fees or cheap options to send money internationally.

- Convenience and proximity: If you care about proximity to physical branches of your bank or ATMs, you may switch banks in the Netherlands for easier access.

- Perks or special offers: Some banks may offer (temporary) promotions such as sign-up bonuses or perks like free travel insurance, which can tempt some people to switch bank accounts in the Netherlands.

- Accessibility: Individuals with a disability or those who have a loved one with a disability may consider switching to a bank that has better accessibility features for disabled people.

- Ethical banking options: Some people prefer to keep their money with a bank that aligns with their ethical values, such as banks that invest in green initiatives or support community projects.

What is the switch service (Overstapservice) for bank accounts in the Netherlands?

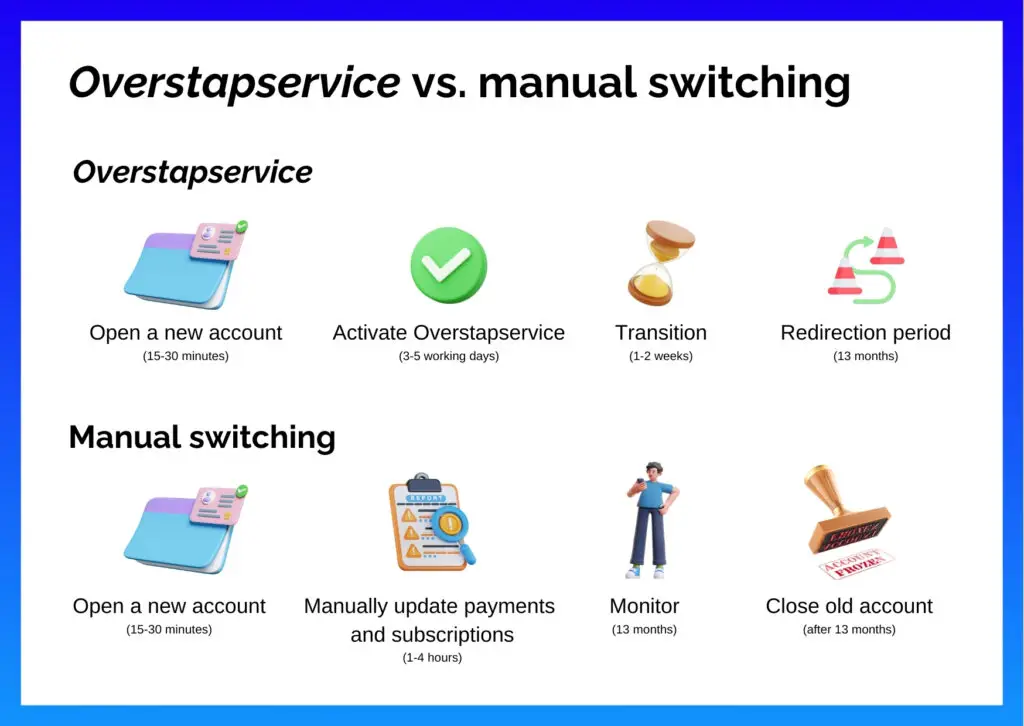

The easiest way to switch bank accounts in the Netherlands is by using the so-called switch service (Overstapservice).

This service is free of charge, and it was jointly launched by some of the Netherlands’ biggest banks to make switching between banks as easy as possible.

Once you decide to change banks in the Netherlands, you can apply for the switch service through your new bank. Your new bank will then contact your old one, and make sure the service is arranged.

When activated, the switch service automatically redirects all payments from your old account to your new one, including direct debits for bills or incoming payments like your salary.

What banks participate in the switch service?

Most of the major Dutch banks participate in the switch service, meaning you can set up a switch between any two of the banks that participate.

In total, 14 banks currently participate in the Overstapservice initiative.

They are:

- ABN AMRO

- ASN Bank

- BNG Bank

- BNP Paribas

- bunq

- Deutsche Bank

- Handelsbanken

- ING

- knab

- Rabobank

- RegioBank

- SNS Bank

- Triodos Bank

- Van Lanschot Kempen

How do I apply for the switch service?

If you want to apply for the switch service to change banks in the Netherlands, you need to request it at your new bank.

To do so, you will first have to open an account with your new bank of choice. From there, you can submit a bank switch request, which will be arranged for you by your new bank.

Depending on the bank, this request can be submitted either via a mobile banking app or the bank’s website.

How long does it take for the switch to start?

Once your request for a bank switch service in the Netherlands is signed and submitted, it will take at least two weeks before the switch service starts.

This time frame can vary between banks and is often lower for online-only banks and a little longer for more traditional banks.

Good to know: You also can choose a preferred start date for the switch service in the future. This can be up to three months from when you submit the form.

Is the switch permanent?

It’s important to note that the redirection of your payments via the Dutch Overstapservice is not permanent. Instead, the service is active for 13 months.

These 13 months are meant to give you enough time to determine whether you want to stick with your new bank or go back to your old one.

The 13-month timeframe was also chosen because almost all deposits and withdrawals occur at least once a year, giving you an overview of all the payments that need to be updated should you decide to stick with the new bank.

One month before the switch service ends, your new bank will send you a reminder.

What happens to my old bank account during the switch service?

During the 13-month period of the Overstapservice, you can decide whether to keep your old account open or close it.

It’s often recommended to keep it active until you’re sure all payments have successfully transitioned.

However, if you do want to close your old bank account, you can indicate this on your switch service application form. Your old bank will then contact you to sort this out.

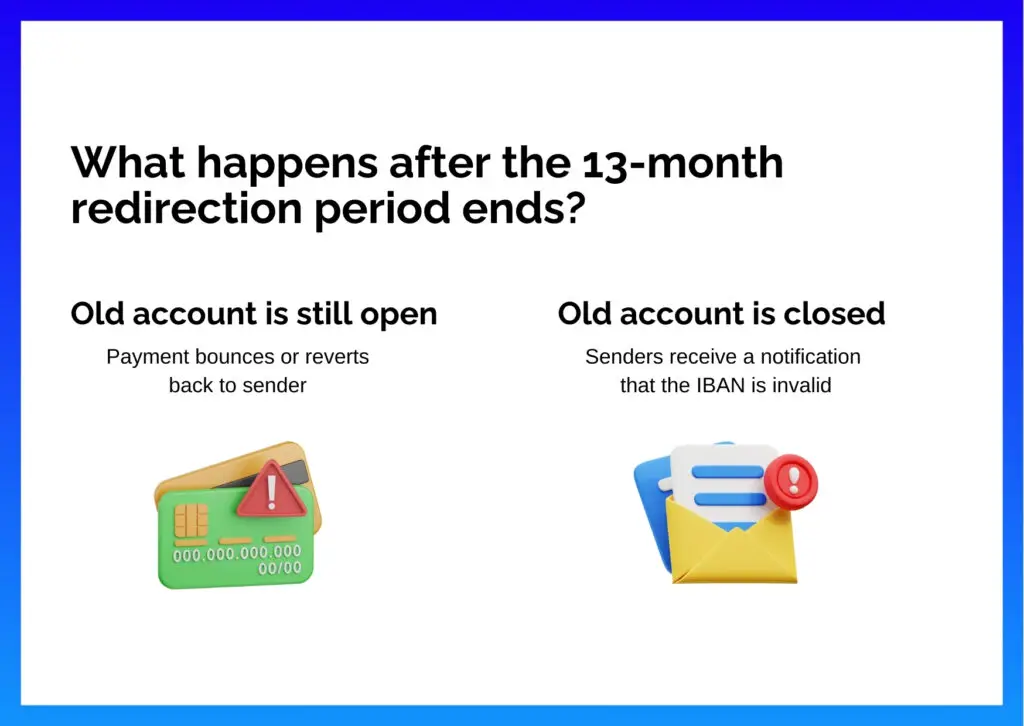

What happens after the switch expires?

After the switch service expires, deposits and withdrawals from your old payment account will no longer be forwarded to your new payment account.

If your previous payment account has not been closed, all transactions to and from your old IBAN will go in or out of your old payment account again.

You can then either:

- Go back to your old account,

- Start a new switch service to redirect payments, or

- Manually transfer all your payments to your new bank to finalise your switch.

If you closed your old account when you made the switch, anyone who tries to transfer or debit money from it will receive a message stating that the IBAN is no longer in use.

6 steps to switching bank accounts in the Netherlands

Switching bank accounts in the Netherlands is relatively straightforward, even if you’re doing it without the switch service.

Here’s how it works step-by-step:

1. Open a new transaction account

Once you’ve put in the research and selected a bank you’d like to open an account with, it’s time to do exactly that: open your new account.

Opening your new account typically involves providing identification (like a passport, residence permit or EU ID) and proof of address. Many banks allow you to open an account online or via their mobile app, and only some apps will allow you to open an account before you get your Dutch BSN number.

2. Optional: Set up your free switch service

If you’re switching to and from a bank participating in the switch service, now’s the time to use it.

This will help automatically transfer your direct debits and standing orders from your old account to your new one while notifying creditors of the change for 13 months.

If you can’t make use of the switch service, or simply wish to immediately do the transfer once and for all, you can skip this step.

3. Transfer your direct debits

If you’re not using the Overstapservice, you’ll have to manually transfer all automatic payments from your old account to your new one.

This can be done by updating your bank account details for things like subscriptions, utilities, and any memberships or services you pay for regularly.

The easiest way to do this is by going through the bank statements of your old account and making a list of all incoming or ourgoing automatic payments from the past 12 months.

4. Notify important contacts about your new account details

If you regularly have people send you money, such as your family, friends, or your employer, then it’s important to inform them of your new IBAN to make sure payments arrive in the right place.

5. Stop your regular transfers

Before you can close your old account, you will also need to stop all regular transfers you have on your account.

For example, if you have a scheduled transfer that puts money from your current account into an investment account each month, you might have to cancel this transaction before you’re able to close the account.

Many banks might also automatically cancel those payments when you close your account.

6. Transfer your funds to your new account

Next up, it’s time to move any remaining balance from your old bank account to your new one and make sure there are no pending transactions before closing the old account.

Banks might also ask you for your new IBAN to make sure all remaining balances can be transferred correctly.

7. Close your old account

Once everything is settled, you can close your old bank account if you no longer need it.

Best banks to switch to in the Netherlands

Want to switch banks but not quite sure what bank to go for? Let’s have a look at some of the best banks in the Netherlands.

bunq

bunq is a modern, fully digital neobank offering a feature-packed banking experience. Many internationals go for bunq since signing up only takes five minutes and requires no BSN.

Though pricier than some alternatives, bunq shines with its innovative features. Users can manage multiple IBANs, create budgets, use auto-save features, and manage an investment account, all in one app.

ING

ING is one of the largest and most well-known banks in the Netherlands, and it is a trusted banking partner for both locals and internationals. With physical branches and expat counters throughout the country, ING is a great choice for those who prefer in-person support.

What stands out with ING are its smart banking features, free student accounts, as well as its all-round financial offers. From banking to mortgages to insurance, ING can help with all of it.

Revolut

Headquartered in London, Revolut is a neobank that has gained popularity in the Netherlands for its innovative approach. With Dutch IBANs, fee-free savings accounts, and no hidden charges, Revolut is a great option for a bank account in the Netherlands.

Want more than just the basics? Revolut’s multi-currency accounts, customisable debit cards, budgeting tools, and investment options have got you covered.

Rabobank

Rabobank is another traditional Dutch bank, loved by many for being the only one without shareholders. Instead, Rabobank has members — a team of customers who help direct the bank and have a say on where its money is spent.

In doing so, Rabobank prides itself in its sustainability and community-mindedness, while also offering an extensive range of personal and business banking services. Users enjoy the ease of managing accounts, setting financial goals, and making payments.

ABN AMRO

Known for its international focus, ABN AMRO is a popular choice among expats and international students. Not only does ABN AMRO provide excellent English-language support, but it also has a strong focus on digital innovation.

That’s why ABN AMRO is a top choice for tech-savvy customers looking for a wide array of financial services.

Can I switch banks in the Netherlands and keep my bank account number?

In the Netherlands, it is not possible to keep your bank account number when switching banks.

That’s because each bank issues its own unique IBAN to each account, so if you move to a new bank, you will also be issued a new IBAN.

The Overstapservice can come in handy by facilitating a smooth transition by assisting with the transfer of direct debits and payments linked to your old account.

Tips for a smooth transition to your new Dutch bank account

Switching bank accounts in the Netherlands isn’t too complicated — but there are still some things you can keep in mind to make the transition as smooth as possible.

These are my best tips:

- Keep both accounts open for a while to ensure all payments, subscriptions, and transfers are updated.

- Notify important contacts about your new account details, such as your family, friends, employer, tax office, and other necessary institutions.

- Transfer your savings accounts as well to make sure you have all your finances in one place and to avoid paying extra fees.

- Download a copy of your transaction history from your old account, for tax purposes or future reference. Once your old account is closed, this information will not be accessible anymore.

- Update all third-party budgeting and payment apps, like Tikkie, to ensure they’ll continue working smoothly.

Switching bank accounts in the Netherlands: Frequently Asked Questions

Can I switch bank accounts in the Netherlands if I have an outstanding loan or mortgage?

Yes, you can switch bank accounts even if you have an outstanding loan or mortgage.

However, it’s important to note that your loan or mortgage agreement will remain with your current (old) bank.

You’ll need to maintain an account with that bank to manage loan payments, but you can still open a new account for your day-to-day transactions and other banking needs.

How long does it take to switch bank accounts in the Netherlands?

Switching bank accounts in the Netherlands usually takes a few business days to complete. This time can vary depending on the bank and the complexity of your banking setup.

If you opt to use the switch service (Overstapservice), the process takes at least two weeks.

Will switching my bank account affect my credit score in the Netherlands?

Good news: the Netherlands has no such thing as a credit score system, which means that switching accounts has no impact on your credit “worthiness” whatsoever.

Are there any costs involved in switching bank accounts in the Netherlands?

The act of switching bank accounts in the Netherlands is free. The only thing you have to take into account are any fees involved with opening a new account (if any).

Can I keep my old IBAN after switching bank accounts in the Netherlands?

No, it is not possible to keep your old IBAN when you switch to a new bank in the Netherlands. Each bank issues unique IBANs, so when you open a new account, you will receive a new IBAN.

One way to “keep” your old IBAN is by using the switch service for banks in the Netherlands, which will redirect payments and direct debits from your old IBAN to your new one for up to 13 months.